Despite a down market for new construction, there were some key advances in tugboat design and technology over the last year.

Notable examples include wider adoption of Tier 4 marine engines in ASD tugboats, as well as orders for tugs with hybrid propulsion. International interest in liquefied natural gas (LNG) tugboats is growing slowly, while in North America the appetite for LNG-fueled tugs remains almost nonexistent. The prospect of unmanned tugs also moved closer to adoption with serious testing overseas.

Through mid-2018, Caterpillar and GE engines have been the choice of Tier 4 early-adopters such as Harley Marine Services, McAllister Towing and Moran Towing. Although that could change once competitors bring their Tier 4 solutions to market, Cat also entered the propulsion market with its first Cat-branded z-drives.

Commander, the first of five 140-foot escort tugs built by Edison Chouest Offshore, is one of the most noteworthy tugs of the year. These vessels, which go to work in Valdez, Alaska, for the Alyeska Pipeline Service Co. starting July 1, have twin Caterpillar C280 Tier 4 engines generating 12,336 total hp and 136 metric tons of bollard pull.

Little action on LNG-fueled tugs

LNG-fueled tugboats are operating in Europe, the Middle East and Asia, and within the last year more projects were unveiled around the world. These gas-powered tugs burn cleaner than marine diesel, but they also cost substantially more to build and outfit.

Here in the U.S. and Canada, operators have shown less interest for LNG as a fuel source. Mike Fitzpatrick, president and CEO of Robert Allan Ltd., said his firm gets a lot of inquiries about alternate propulsion, particularly LNG or dual-fuel engines. Most of the time, those inquiries don’t lead to construction of an LNG-fueled tug.

“The capital cost is so much higher than a conventional boat. It is still at this point impossible to build an economic case for a dual-fuel tug,” he said during an interview in his Vancouver, B.C., office.

“If you turn a $10 million tug into a $14 million LNG-fueled tug, that is really what we are talking about here. The delta is somewhere between $3 and $4 million,” he added.

Although a handful of RAL-designed LNG tugs are currently in service, under construction or about to take shape in Asia and elsewhere, economics alone were not the leading factor in choosing “green” propulsion systems. For instance, government subsidies will help fund the construction of vessels for PSA Marine in Singapore, reducing the difference between the cost of LNG and standard diesel propulsion.

Jensen Maritime and other big naval architecture firms also have developed LNG tug designs, and the Shearer Group of Houston is among major towboat designers working on LNG fuel for inland vessels.

There have been notable advances in LNG-fueling infrastructure in the U.S. — particularly in Jacksonville, Fla., for new LNG-powered containerships — but even in a harbor tug capacity, widespread adoption is likely a ways off.

Hybrid tug projects under construction

Nearly a decade after Foss Maritime launched Carolyn Dorothy, the first hybrid-powered U.S. tugboat, other operators have announced diesel-electric projects of their own. Primary benefits of hybrid systems include reduced fuel burn, lower emissions and less wear on main engines.

|

|

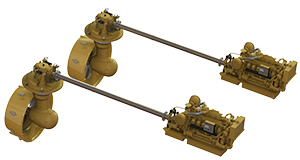

Caterpillar offers an integrated propulsion system that includes z-drives. |

|

Caterpillar Marine |

Seattle naval architecture firm Jensen Maritime Consultants was chosen to design a 100-foot hybrid tugboat for Baydelta Maritime of San Francisco. Nichols Brothers Boat Builders on Whidbey Island, Wash., is building the vessel, and delivery is expected early next year.

Propulsion on the new tug will come from twin Caterpillar 3516C Tier 3 diesel engines, rated at 2,675 hp each. Rolls-Royce hybrid technology featuring two 424-kW electric motors powered by three CAT C9.3 generators will allow speeds up to 8 knots in electric-only mode. Bollard pull will be 90 short tons in combined diesel-electric mode. This project will be the first Rolls-Royce hybrid system installed on a tugboat.

Some 3,000 miles away, Washburn & Doughty of East Boothbay, Maine, is building two hybrid tugboats for Harbor Docking and Towing of Lake Charles, La. These 5,100-hp Tier 4 vessels will feature Caterpillar equipment from “stem to stern,” including the hybrid propulsion system.

The cost difference between hybrid and conventional tugs is about $1 million, according to Robert Allan Ltd.’s Fitzpatrick. He estimates a hybrid harbor tug working 2,000 hours a year at a 30 percent load factor could run on one main engine about 90 percent of the time. As such, it could cut the running hours on the engines in half.

“That’s where you start making an economic case for it,” he said.

Automation takes a step forward

At this point it’s likely a matter of when, not if, automation gains a serious foothold in the maritime industry.

One major breakthrough occurred last July, when Rolls-Royce and tug operator Svitzer demonstrated the world’s first remotely operated commercial vessel in Copenhagen, Denmark. The vessel was the 28-meter Robert Allan RAstar ASD tug Svitzer Hermod. Rolls-Royce also plans to launch crewless tugboats and ferries by 2020.

From a wheelhouse in Svitzer headquarters, a captain remotely berthed the vessel, undocked, spun 360 degrees and sailed to Svitzer’s offices and docked again. The tug was equipped with numerous Rolls-Royce sensors and communications equipment including a dynamic positioning system, Lidar laser scanning, multiple cameras and other gear.

Oskar Levander, Rolls-Royce Marine’s vice president for innovation and digital systems, expects remote-control technology could lead to development of autonomous tugs. But there are technical challenges still to be overcome.

“We have demonstrated the situation awareness for navigation and operations for ship assistance,” he said, “but how do we autonomously hook up ropes?” He expects developments in robotics will provide the technology for handling mooring ropes remotely.

Robert Allan is working on several semi-autonomous or remote-controlled projects right now, including tugboats and fireboats, Fitzpatrick said. He expects the technology to advance first in Western Europe, Australia, Singapore and the U.S., where wages are high and safety regulations are more strictly enforced.

American Tugboat Review editor Casey Conley contributed reporting.