With Subchapter M now firmly in place, the clock is ticking for the deadline of July 20, 2018, when the U.S. regime for the inspection of towing vessels fully takes effect. That’s the date when many existing vessels need to meet the requirements.

As the industry embarks on this regulatory path for the first time, operators and consultants are learning how the process works and which areas are causing problems.

Vessels built after July 20, 2017, or vessels undergoing a major conversion on or after that date will need to comply with Subchapter M and obtain a certification of inspection (COI) before operating. For existing vessels, at least 25 percent of a company’s fleet must have a COI by July 22, 2019. For each subsequent year, another 25 percent must obtain COIs. All vessels are required to have them by July 19, 2022.

A key factor in this process is the state of the towing sector. Subchapter M is taking effect when the industry is having a difficult time economically in many markets, said Jennifer Carpenter, chief operating officer for the American Waterways Operators (AWO).

“This is an economic reality that we need to be aware of,” she said, adding that the U.S. Coast Guard at all levels has made it clear “that the goal here is to make the industry safer and to do that with no interruption in operations.”

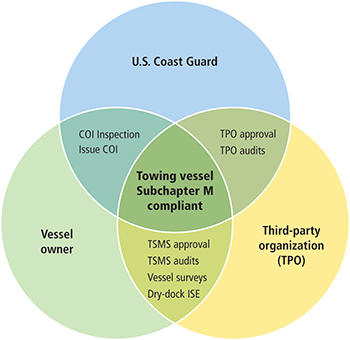

Owners and operators have two choices for compliance with Subchapter M: undergo annual Coast Guard inspections, or adopt a towing safety management system (TSMS) in which the audits and surveys that are part of the rule are conducted by a Coast Guard-approved third-party organization (TPO). The Coast Guard also will accept safety management systems that comply with the International Safety Management (ISM) Code and AWO’s Responsible Carrier Program (RCP).

|

|

Owners and operators who select the towing safety management system (TSMS) option for Subchapter M compliance must complete management and vessel audits. This is done through a third-party organization or group that can perform the work of a TPO. |

The first option requires Coast Guard attendance at annual Subchapter M inspections and at dry-dock and internal structural examinations (ISEs), which are required every five years for freshwater vessels and twice every five years for saltwater vessels. Permission to go to another port for repairs after an inspection requires approval by an officer in charge, marine inspection (OCMI).

Robert Russo, chief executive officer for First Coast Maritime Consulting of Jacksonville, Fla., which works with the Towing Vessel Inspection Bureau, said Coast Guard inspectors can provide limited guidance outside the inspection. The initial inspection must be scheduled three months in advance, which applies to both the Coast Guard and TSMS options.

Companies will have to fit inspections into the schedule of the regional OCMI. If a vessel fails the Coast Guard inspection, it could be difficult to get re-inspected in a timely manner, Russo said. “You may not get a certification or a temporary certification. You may have to tie the boat up,” he said.

But working with the Coast Guard on Subchapter M could still make sense for some operators, said Joshua LaVire, regional vice president for the American Bureau of Shipping (ABS). “I think (for) small companies that operate in a small geographic or regional area that have a good relationship with the local OCMI and that won’t have a scheduling issue, then the Coast Guard is a viable option for them to consider,” he said.

Other consultants told Professional Mariner that there is no significant benefit in choosing the TPO option over the traditional Coast Guard inspection, and that operators should beware of being overcharged. However, advocates of using the TSMS option for the Subchapter M process say the advantage is that operators have much more flexibility.

Management audits must be conducted before a TSMS is issued, and two external management audits and one external audit of the company must occur every five years, which can be conducted by a TPO. Vessels using the TSMS option need a Coast Guard inspection once every five years; however, required dry-dock and internal structural exams over five years can be done by the TPO. This option also requires a TSMS certificate at least six months before getting a COI.

Companies that have not been keeping up with Subchapter M can run into problems. If a smaller company is not part of the AWO’s Responsible Carrier Program or has not worked under another best-practices system, compliance could be difficult.

“It’s hard to just create something,” said Luke Guidry Jr., operations manager for Lorris G. Towing of Cut Off, La., which operates 11 pushboats for Kirby Inland Marine. “If you don’t have anything written down, or you didn’t do it, you have to create something out of thin air.”

Lorris G. Towing has completed the RCP, which was approved by the Coast Guard and, with some small modifications, was accepted as a TSMS. In addition, five years ago the company complied with the Tanker Management Self Assessment program, a voluntary system used by maritime companies transporting oil. Many of the best practices for the tanker plan are similar to Subchapter M.

One of the law’s requirements that concerns Guidry is the dry-docking provision. “There is a limited amount of dry-dock space in our area,” he said, adding that operators also have to make sure that repair companies and shipyards are following the correct standards. However, LaVire said that the Coast Guard is not requiring a dry dock prior to issuing a COI.

Russo said he has come across operators who inadvertently have not been following Subchapter M standards. “For example, I went on a towboat in Belle Chasse, La., recently and the operator had used a regular electrician to perform some maintenance, and household electrical practices are not maritime electrical practices,” he said. “And many commercial boatyards don’t have ABYC (American Boat and Yacht Council) certified technicians working for them, so yard personnel might not be completely aware of the standard.”

|

|

Dann Ocean Towing’s Ocean Tower plies the waters of Boston, Mass., in September. Under Subchapter M, vessels that regularly operate in salt water are subject to a more rigorous dry-docking regimen than freshwater vessels. |

|

Courtesy Ken Lane |

Operators can use ABYC standards for electrical systems, gasoline and diesel fuel systems, marine inboard engines and transmissions, and electric bilge pump systems, among others. Existing vessels approved by a certified classification society are also in compliance with the machinery and electrical provisions of Subchapter M. However, the ABYC standards “are the best practices,” Russo said. “You have to blend regulations, safety and best practices.”

Larger operators are faced with coordinating big fleets for Subchapter M. Challenges include “tracking all vessels over multiple geographic areas, some operating on rivers, some along the coast (if) they have inland fleets and offshore fleets,” LaVire said. These large operators have to keep track of extensive documentation and may have to install new computer programs to gauge compliance with the new regulations. Scheduling the work that needs to be done for a large fleet will be a major issue.

Guidry said another concern is about older vessels that are non-standard. “Most of these boats were built in a cow pasture,” he said, referring to older vessels in Louisiana. “They were drawing on a piece of steel.” These older boats do not have technical drawings or specifications done by a naval architect.

Carpenter said operators should not assume that older, non-standard boats won’t pass. “Under Subchapter M, the Coast Guard is not going to say, ‘You built this boat 30 years ago in a cow pasture, so it is not in compliance,’” she said. “They are going to say, ‘Is this boat in good operational condition?’”

The Coast Guard has estimated that Subchapter M will require between 500 and 600 surveyors and auditors, according to Russo. The Towing Vessel Inspection Bureau is planning to train 300 surveyors for the new regulations, he said, and LaVire said ABS has about 200 full-time auditors and surveyors.